Since its founding in 2005, Diaceutics Plc has carved a niche in helping pharmaceutical companies bring precision medicines to market from its base in Belfast. Operating in the healthcare technology industry – specifically in diagnostic commercialisation – the company focuses on ensuring patients get the right treatments by optimising diagnostic testing for targeted therapies, a critical step in personalised healthcare.

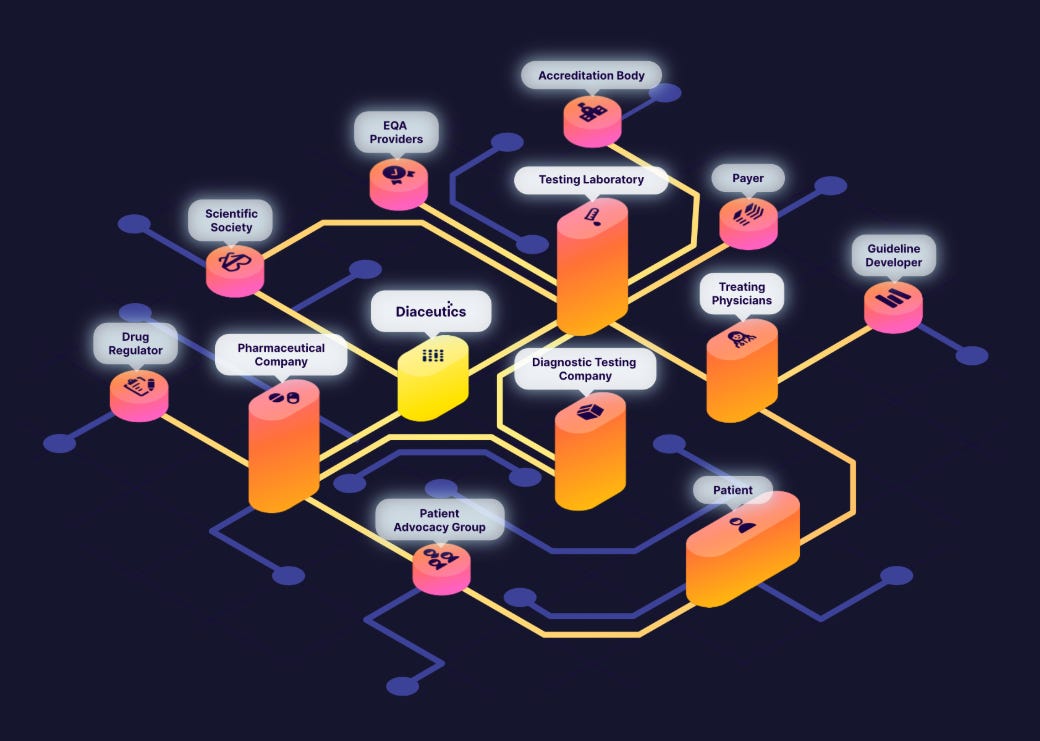

Diaceutics earns revenue by providing data analytics and implementation services to 39 of the world’s leading pharmaceutical firms, including industry leaders like Novartis and AstraZeneca. Its core offering is DXRX – The Diagnostic Network, a platform that integrates real-world diagnostic testing data from a global network of over 2,500 laboratories across 53 countries. This platform helps pharma clients launch precision medicines, which are drugs tailored to specific patient groups based on genetic or molecular factors, often used in fields like oncology, multiple sclerosis, and rheumatoid arthritis. Diaceutics charges fees for its end-to-end solutions, which include diagnostic market research, laboratory mapping, testing strategy, and reimbursement support. For example, it might help a pharma company ensure that testing for a new cancer drug is widely available at launch, maximising adoption and sales. The business is small despite approaching its twentieth anniversary. In 2024, it reported revenue of £32.9 million, which represents a good percentage rise on previous years but nevertheless still makes it loss making.

The company also generates income by licensing its vast repository of diagnostic data, which it has built by working on every precision medicine brought to market since its inception. This data helps clients understand testing landscapes, identify gaps in diagnostic access, and improve their return on investment by ensuring the right patients get the right therapies. Diaceutics also offers consulting services to navigate the complex reimbursement landscape, helping pharma firms secure funding for diagnostic tests in various healthcare systems. However, the diagnostic market is fragmented, and Diaceutics estimates its addressable market at £0.5 billion, indicating room for growth but also competition.

Diaceutics benefits from the growing precision medicine trend, driven by advances in genetics and diagnostics, which are transforming how diseases are treated. However, it must navigate a complex regulatory environment, varying by country, and the risk of ineffective testing slowing drug adoption. Its focus on data-driven solutions and global reach positions it well, though it needs to address market volatility and competition to sustain its momentum.

This is a business that requires specialist knowledge of a complex market. This doesn’t preclude further investigation but makes the job more challenging. The fact that the founders and directors own so much stock is a positive but the fact that after twenty years of operating it is still yet to turn a profit is eye opening. The era of personalised medicine certainly seems to be dawning however and if (big if) Diaceutics is a beneficiary then there is reason to believe this could be special. For now, Wonder Stocks adopts a lukewarm stance on the business. This means that it could be worthy of work but it is not a priority.