A FTSE100 Company with medium-term multibagger potential?

A big business that could generate big returns.

There is a company on the FTSE100 that not many have heard of and even fewer care about. Yet, it has generated 6,500% total return over 30 years. It has never been expensive but today it is very cheap. It has executed on the same strategy consistently for decades and still continues to perform well. Should management deliver on what they say they will in the next five years, the shares could offer 250% total return. Read on to find out more.

Note: Wonder Stocks seeks to provide a narrative argument for its investment case. Nevertheless, figures and charts can be found in the appendix.

A Super Cheap Growth Story

Discover more wonderful investment ideas here.

DCC has made investors a lot of money over the years. There is no reason to suspect that it can’t do in the future. Considering its historically high rate of value-creation, the shares have never looked particularly expensive. Since 2018 however, a combination of a refocused strategy and a COVID-induced temporarily reduced growth rate, has left the shares downright cheap. In 2022 the management unveiled a new strategy that amongst other things implied a more than doubling of profits by the end of the decade. Since then, updates to this strategy have been better than earlier guidance. In early 2025, with the shares around 5400p, an argument can be made that the shares could deliver 250% over the next five years. Moreover, most probably the good times would continue beyond there. This gives DCC, the prospect of delivering a multi-bagger for shareholders.

The business has been listed since 1994. In its first 25 years, it delivered c. 6,500% for those investors patient enough to hold on. It did so through a repeatable and logical investment process. Wonder Stocks believes that DCC can continue to make very attractive returns. But better still, with the shares trading at an historically cheap level, these attractive returns could be supercharged. By taking DCC’s own, probably conservative, forecasts for the year 2030 and making a few modest assumptions one can generate a return of c. 250% over the next five years. These assumptions include; similar rate of acquisitions to its history, a return to a more normal valuation, the sale of the Technology and Healthcare businesses at a modest multiple, and the continuation of the dividend.

What Is It?

DCC is a buy and build business. It makes money by buying small businesses and investing in them for growth. The key to this strategy is that it pays a low price for the businesses that it acquires and integrates them with care. There are many success stories in buy and build and they can operate in numerous different sectors (Wonder Stocks highly recommends reading Brad Jacobs new book on this topic – How to Make a Few Billion Dollars). The attraction for investors is that they are simple to understand although execution requires a sound process and discipline. DCC has comprehensively demonstrated the soundness of its process and its commitment to discipline over the years. It has completed nearly 300 acquisitions in the last thirty years.

In its first 25 years, it delivered c. 6,500%

DCC was founded as the Development Capital Corporation by Jim Flavin in Ireland in 1976 and was Ireland’s first venture capital business. The mission was to provide capital to unlisted growing companies and provide them business with development expertise to help fuel growth. It operated as a private business for 18 years before listing in the UK in 1994. In 1990 the company transitioned from its venture capital type investing to become a business operator. It was at that point that it officially became known as DCC.

In 1990, the company began to dispose of its investments where it was a mere shareholder rather than an operator. Over the next four years, the company was rationalised down to four core areas, Energy, Technology, Environmental and Food. Energy was the largest and was mainly involved in domestic fuel distribution and the operation of petrol stations.

1994 to 2018: Gigantic Returns

This section can be skipped for those wanting to understand the investment case without knowledge of the history. Ultimately however the returns were driven during this period.

By 1994 the company was fully an operator rather than a mere investor. Still, it retained the strategy to acquire smaller businesses with the potential for growth. In that sense it morphed into a buy and build business. A key benefit is that being a listed company would lower its cost of capital. That is to say that as a listed company, DCC could raise additional capital more cheaply. This created a larger gulf between DCC’s cost of capital and acquiree businesses, which improves DCC’s negotiating position and gives an easier route to value creation.

The four business units at the time of listing expanded to five in 1998 with the entry into the Healthcare market. The common theme across the divisions is that DCC was providing a service to third parties in production and/or distribution of products. For the next ten years, the company continued to acquire businesses for attractive valuations and integrate them into the one of the five divisions. However, much of the capital investment was going towards the Energy business.

In 2008, the founder and CEO, Jim Flavin, retired. He had a successful 32-year tenure at the business, although not one without controversy (see Fyffes Controversy in the Appendix below). During the previous fourteen years, the net asset value per share had increased by 1,000%, whilst paying a modest but progressive dividend. His successor was Tommy Breen, who had been with the company for 23 years at the time, with the previous eight years as a board member as Chief Operating Officer.

Mr Breen then changed to CEO for nine years before retiring at 62 years old in 2017. He was replaced by Donal Murphy, who remains CEO. He started working for the company in 1998 at the age of 33 and had spent the eleven years prior to his current appointment as managing director of DCC Energy; the largest part of the group. He will be 60 years old in May 2025. Overall, in its near 50-year history, DCC has had only three CEOs, all of which could be described as DCC-lifers.

During Mr Breen’s tenure, the company focused on a smaller number of sectors where the group had a strategic advantage. This led to the disposal of the Food business unit in 2014 and the Environmental business unit in 2017. Mr Murphy came from the Energy business unit and so has focused on this during his tenure. In the eyes of many investors, and possibly the market given the current valuation, this is where the business began to hit problems.

2018 to 2022: Why is DCC Cheap?

This section shouldn’t be skipped because it explains why it is cheap.

In 2017, the group entered the large US LPG (Liquefied Petroleum Gas) delivery market with the acquisition of Retail West (since renamed DCC Propane). This was supposed to be the start of a new investment in consolidating a large market. It coincided with a step change in acquisition spend with more than £900m spent in the previous twelve months.

At the time, management stated that the company needed more capital to exploit the tremendous opportunity they believed was in US LPG. In Q4 of 2018 there was an equity placing of 10% of the share capital. This raised over £400m in additional funds. What followed was a period of disappointment. Instead of making several acquisitions in US LPG, the company found it difficult to close transactions as valuations demanded by sellers were consistently too high. This meant far less was invested in new businesses in the following 18 months than had been hoped. By the end of that 18-month period it was March 2020 and the COVID-19 pandemic radically altered priorities.

Whilst it had proved tricky to close acquisitions in 2019, by 2020 it had become very difficult indeed. Although, there were acquisitions completed through the pandemic, these were mainly ones where the process had been started before the pandemic. The result was that organic growth had slowed because of COVID-19, acquisition growth had also slowed because of fewer deals being closed and margins were under-pressure from COVID induced challenges. Having reached a share price in 2019 of 7500p, the shares have consistently declined since. The company is bigger and more profitable than in 2019 yet the shares are much lower. Even conservative assumptions about the future imply that earnings could increase substantially.

2022 to Present: Will It Stay Cheap?

In 2022, the management held a capital markets day where it presented a change in strategy. The day was titled ‘Leading With Energy’. The company stated that its focus on gas and recent investments in renewable energies was providing a solution to the decarbonisation problem faced by its customers. As a strategy, it had aims for what the company will look like in 2030 as well as 2050 and the likely pathway to those years. Essentially, it was a demonstration of how DCC Energy would exploit the opportunities that are coming about through the Net Zero agenda.

Leading With Energy

DCC Energy operates in the lower carbon areas of the energy market like natural gas. Historically the business has used this position to help customers transition towards lower carbon energy as they grapple with tightening environmental regulation. In 2022 management made explicit their goal to alter DCC Energy into a business with the aim of exploiting the trend towards Net Zero.

To that end, recent acquisitions and internal investments have been towards providing multi-energy solutions that emphasise installation and maintenance of renewal energy. The division is internally separated into two sub-divisions, Energy Solutions and Mobility. Energy Solutions leverages the existing customer relationships to reduce the complexity of transitioning to lower carbon energy. This service is offered to both commercial and domestic customers. Mobility provides energy to vehicles via its fuel stations. This includes EV charging but also fuel services to hauliers, which remain reliant on carbon fuels.

In practice this doesn’t represent a particularly big shift in the business but rather alters the course slightly. Below is a summary of how the service offering is changing compared to pre-2022.

As is always the case for buy and build businesses, the key to value creation is buying businesses that trade on a lower multiple to the acquirer (DCC) and improving them. This is what DCC has achieved masterfully over the decades. Despite the challenges, in the five years prior to the 2022 strategy change, the Energy business had increased operating profits by 45% with returns on capital improving from 16.5% to 18.5%.

DCC has a track record of presenting a very conservative outlook to the market and regularly beating it. This is something seen in the very best managed business like Next PLC, which is well known for the practice. It is with this knowledge that the 2030 projections and subsequent updates should be considered. Using just the existing businesses (i.e., not including any further acquisitions), management imply that the operating profit will double between 2022 and 2030. This would represent a compound average growth rate (CAGR) of 9%. Wonder Stocks believes this is a very credible target growth rate given a. the historic rate of growth and b. Wonder Stocks’ opinion that DCC is currently generating unusually low returns. Adding the likely dividend, which at time of writing is yielding 3.6% then there would be a 12.6% CAGR return on offer. However, in a typical year, the amount spent on acquisitions is roughly double that of the amount returned via dividends.

Operating profit should double between 2022 and 2030

Should the company cease acquisitions, then net debt would be wiped out in c. three years. In this unlikely scenario, by 2030, the company would be able to return approximately one third of the market capitalisation in capital. Most probably however, this excess capital will be invested in new acquisitions, which should further boost 2030 profitability. Assuming c. £1.5b in acquisition by 2030 (in line with the run rate) and historic returns on invested capital, operating profits would be c. 20% to 25% higher than without acquisitions.

Actions in 2024

In 2024, DCC updated the market on its 2022 plan. The main takeaway was that operating profits would be approximately 4% higher than previously guided. This is a clear example where DCC has proved to be conservative because the group beat its projections.

During its history as a listed business, DCC has traded on an EV/EBIT of around 14x. Considering the rate of value-creation this is very modest. As a result of the aforementioned issues in the period 2018 to 2022, this valuation had reduced to 11x by the time of the Leading With Energy update. One assumes that internally there was hope the strategy would reinvigorate the valuation. Yet instead, the valuation continued to drift ever lower so that by the time of the 2024 strategy update, it was trading around 9x, having briefly gone as low as 8x during 2023.

the valuation continued to drift ever lower

This valuation is far too low. Buy and build business’ primary sources of value-generation are buying companies that are cheaper than their own stock and improving them. DCC is adept at improving acquired businesses but its valuation is too low for the first part. Late in 2024, management has begun to take even greater actions to address this problem. In November, it was announced that the Healthcare business unit is being sold in 2025 and the Technology business unit will be sold thereafter. Both of these businesses will be very probably sold for more than DCC’s current valuation and therefore, their effect would be to make DCC Energy even cheaper. I.e., selling two businesses worth 25% of profits for more than the group valuation, will lead the remaining 75% to be cheaper all else equal.

Finally, with this announcement, the market reacted positively. On the day, the shares leapt 20%, though have since drifted back to trade around 12% higher than before the announcement. The intention is to return the capital from the business disposals to shareholders. The tacit statement therefore is that the company is cash generative enough to fund the energy investments without recourse to further cash. Logically, given the low valuation, this capital return will be enacted via a share buyback rather than special dividends.

How Much Can Shareholders Make?

It is stated at the start that 250% is available over the next five years, which represents 29% CAGR. For those not numerically inclined, this should be considered the bullish case. However, it should be noted that value creation should continue well beyond 2030 implying 250% would merely be the start. For the more numerically inclined, the assumptions are set out below.

29% CAGR

In order to generate a 250% total return the following is assumed:

Valuation as measured by EV/EBIT returns to the long run average of 14x from c. 9x today.

The business generates 9% growth per annum organically in line with company announcements.

The business generates 4% growth per annum from acquisitions in line with historic rates of growth.

Acquisitions cost the entirety of free cash flow after dividends but no more leaving net debt static. I.e., no more debt is issued nor repaid in pursuit of acquisitions. This is not necessarily accurate, but its accuracy is immaterial to the end outcome. As an assumption it exists to aid in generating a return profile.

The business generates a 3.6% dividend yield, which is reinvested.

The company completes share buybacks totalling c. 22% of the market capitalisation through the disposal of Healthcare and Technology businesses. This may prove to be a low number and therefore there is further upside should it prove conservative.

Using these assumptions, the terminal market capitalisation would be c. £12.5b compared to £5.4b at time of writing. The share count would lower 22%, increasing the per share value by 28%. Together, this would represent a total return of 200% or 24.5% CAGR. An assumed dividend rate commensurate with current rate reinvested, increases the CAGR to c. 29%. This totals to 257%.

As stated, this should be considered a bull case but should be also considered feasible. The most likely of the assumptions to miss would be the valuation returning to its long run average. Assuming the valuation returned to a more conservative 11x then the five-year total return drops to 170% or a CAGR of 22%.

Overall, DCC represents a rare investment. That is one that is cheap and has a credible strategy to growth. The difficulties the business went through were partly self-inflicted and partly because of the COVID-19 pandemic. The management are adept at generating good value for shareholders having done so for decades. With the shares so lowly valued there is tremendous margin of safety in an investment in DCC, which could also provide a bumper return.

Appendix

Financial Information

Note about DCC Rerport and Accounts; DCC switched from reporting in euros to pounds in 2014.

Record of Valuation Creation

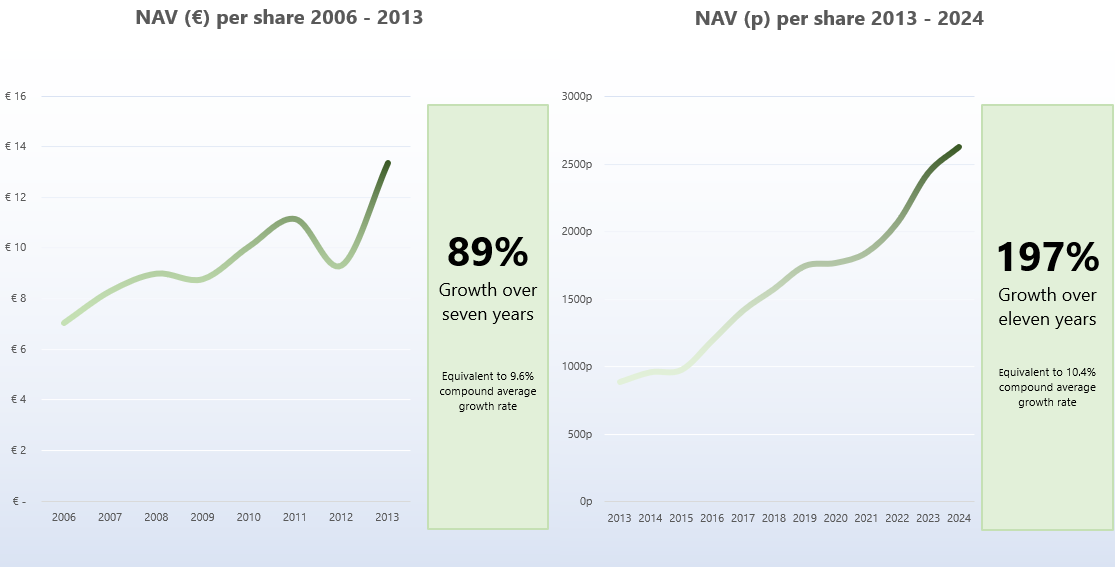

In total, DCC grew its per share net asset value by 461% between 2006 and 2024. This is equivalent to 10% compound average growth rate.

Profitable Growth

NOPAT ROIC (Net Operating Profit after Tax return over Invested Capital) is a proxy for free cash flow return on capital. It is a good indication of the profitbaility of the acquisitions that the company. Hstorically it has been in the range of 12% to 14%. However during the the period from 2018 it has been in decline. One bullish case for the stock is that the pre-2018 period was more normal and the period since 2018 is an aberation. In order to hit the 2030 targets, the NOPAT ROIC would have to return to c. 12%, in line with the historic levels.

The Importance of Acquisitions

The three main uses of cash are dividends, capital expenditure and acquisitions. Dividends represents returns to shareholders, capital expenditure represents maintenance of existing operations as well as organic growth, and acquisitions represent acquired growth. Acquisitions averages c. 50% of the use of cash, dividends are c. 30% and capital expenditure is c. 20%. Of the 20% on capital expenditure, Wonder Stocks estimates c. 1/3 is for expansion and generates growth and 2/3 is for maintenance of the existing business. DCC is very cash generative.

Earnings and Dividends

Over the last eighteen years the company has grown earnings per share by 189%, which represents a compound average growth rate of 6%. Dividends have grown over the same period by 440%, which represents a compound average growth rate of 10%. This disparity in growth has caused the dividend cover to have fallen from 3.5x to 1.8x over the period. However as can be observed in the NOPAT ROIC chart above, the company has seen its returns on capital decline since the problems of 2018 to 2022. Should profitability return to old levels as implied by the company itself, then earnings would be c. 35% higher and total earnings growth over the period would be c. 290%.

Historic Valuation

The EV/EBIT valuation for DCC is below (source ShareScope). For most of its existence, it has traded at a level between 11x and 18x. The two exceptions are during and immediately after the Global Financial Crisis (GFC) around 2008, and today. The chart includes analyst forecasts for these years and up to March 2027. At which time, the EV/EBIT will be c. 8x. Using DCC guidance and Wonder Stocks internal analysis, the EV/EBIT will drop to around 5.5x by 2030.

The Fyffes Controversy

Fyffes is a fresh fruit produce company in Ireland. In the 1990s until early 2000, DCC owned just over 10% of Fyffes and Jim Flavin, the then CEO and chairman of DCC sat on the board of Fyffes. Allegedly, Mr Flavin was made aware of poor profits at Fyffes in early 2000 ahead of it becoming public information and arranged for DCC to dispose of its stake in Fyffes. The allegation was that Mr Flavin directed DCC to act on material non-public information (commonly known as insider trading).

Fyffes took a case against DCC in the Irish High Court but lost the action. In 2005, Fyffes challenged the High Court’s decision in the Irish Supreme Court. It too was found against Fyffes. Nevertheless, there remains controversy with many Irish newspapers casting doubt Mr Flavin’s actions in 2000. Ultimately, in 2008, Mr Flavin resigned/retired. It is difficult to know what would have happened had the court exonerated Mr Flavin entirely but his departure was fairly sudden. It must be noted however, that he was 66 at the time of his retirement so was at retirement age.

DCC’s report on the Fyffes controversy can be found on page 65 of the 2010 report and accounts.

Here is a negative opinion piece published in the Irish Independent from 2010 for those interested in learning more.

Disclaimer:

The author of this Wonder Stocks piece is Jamie Ward. As at time of writing, he owns shares in DCC. Unless stated otherwise, all sources of information come from DCC Report and Accounts, DCC presentations and Wonder Stocks’ analysis.

The company makes about a 10% return on equity. That’s barely above the cost of capital. A business’s quality is pretty directly related to its ability to earn an above-market return on investment. If ROE = cost of capital, growth does not create any value. 9x EBIT is a pretty fair multiple for such a company. To believe this is undervalued, you have to believe return on capital is going to increase in the future. Is this the case?

Also, I wonder if there might be a contradiction in your assumptions. You assume 9% annual growth, but you also assume they dispose of the healthcare and technology businesses - is this factored into the 9% growth rate??