Growth Priced Like Deep Value

What if a tiny UK stock could turn a modest stake into a fortune?

There is a superbly well-run business in the digital advertising sector: a UK-listed micro-cap that is growing impressively and trading at a stupendously low valuation. Advertising can be enormously profitable, but the sector is replete with badly managed businesses. However, this company stands out, placing it in a uniquely advantageous position to generate highly profitable growth for years to come. Furthermore, it is comically cheap. Should the management execute on its strategy well, the returns could be enormous.

Wonder Stocks seeks to provide a narrative argument for its investment case. Nevertheless, supporting figures and charts can be found in the Appendix.

Discover more wonderful investment ideas here.

A Stock with Everything

As a stock, Brave Bison offers the full package. It is a compelling turnaround story, providing investors with exposure to a business that is delivering improved profitability. At the same time, it operates in a high-growth market, benefiting from strong industry tailwinds. Its strategy is built on a “buy and build” approach, accelerating expansion and adding further momentum. Despite these strengths, the stock remains remarkably undervalued. Adding to its appeal, Brave Bison boasts a rock-solid balance sheet and a leadership team with significant skin in the game. Combined, these factors create the potential for exceptional shareholder returns.

Brave Bison's client list includes UK retailers like Currys and Holland & Barrett, global brands such as New Balance and Asus, and high-profile sports organisations like Real Madrid and the International Cricket Council.

The company specialises in performance marketing, e-commerce solutions, social media content creation, and digital publishing. These services are delivered through four main business segments:

Brave Bison Performance

Focuses on data-driven marketing solutions, leveraging advanced digital advertising techniques such as paid media, search engine marketing, and performance-driven creative strategies to optimise campaigns for brands. This segment helps clients maximise return on ad spend across multiple digital platforms.

Brave Bison Commerce

Delivers end-to-end e-commerce solutions, including web development, digital transformation, and conversion rate optimisation, alongside integrated digital marketing to help brands stay competitive in online retail.

Brave Bison Media Network

The company’s in-house digital media business, operating a portfolio of owned and operated content channels across YouTube, Facebook, and other social platforms, reaching millions of viewers worldwide. It generates advertising revenue and branded content partnerships by leveraging audience insights and platform expertise.

Social Chain

Acquired by Brave Bison in 2023, Social Chain is a social media marketing agency specialising in influencer partnerships, viral content, and community-driven brand campaigns. It helps brands engage younger audiences through culture-driven storytelling on platforms like TikTok, Instagram, and X/Twitter. The company was founded in 2014 by Steven Bartlett, well known as a Dragon’s Den investor and host of The Diary of a CEO podcast.

On The Up

The marketing industry is full of small, poorly run businesses. Many of the most creative minds can secure big clients but struggle with business management. For Brave Bison’s directors, this presents a major opportunity. The company’s history is divided into two eras: before 2020 and since 2020 (although this may seem like it is COVID related, it is not). Before 2020, Brave Bison was mismanaged, racking up nearly £125m in losses over eight years. That changed when brothers Oliver (Oli) and Theodore (Theo) Green acquired a major stake and took control in 2020. Their leadership marks the beginning of what can be called the Green era. Oli, then 27, became Executive Chairman, focusing on driving the strategy and overseeing senior management to ensure operational excellence. Theo, then 25, took on Chief Growth Officer, driving growth through management of the sales function as well as pursuing the acquisition strategy.

Oli and Theo are sons of Michael P. Green, a very successful entrepreneur who built up, listed, and eventually sold Carlton Communications, the remnants of which exist to this day in ITV, though the name is no longer used. Through Michael’s first marriage, the Green family is linked to the Wolfson family, another set of very prominent British entrepreneurs. Together, these families form a major part of British business and contain some very talented and well-connected businesspeople. It was with his then father-in-law, Leonard Wolfson, that Michael set up the first business in 1967, Tangent Industries. Tangent are a series of businesses covering different areas of media and seemingly entirely run by his children (he has six) or other close family. Oli ran the Tangent Marketing Services business, where Theo also worked, alongside a stint in private equity. So, whilst Oli and Theo were clearly very young and bold to be muscling their way into running a business, they are well-connected and grew up surrounded by entrepreneurialism, giving them a unique network of businesspeople to help hone their business acumen.

Truly Remarkable Returns

Brave Bison appears highly undervalued. Based on management’s adjusted profitability figures (see Appendix I), the shares trade at a mid-single-digit earnings multiple when factoring in the company’s substantial cash reserves. Its position in a fast-growing sector only makes this valuation seem even more attractive. Purely as a value play with strong growth potential, Brave Bison offers the prospect of solid returns. To achieve truly exceptional gains, though, investors must take a long-term view - one that hinges on identifying and backing outstanding management teams. For this Wonder Stocks assesses six principles of excellent management across all companies:

Six Prinicples of Excellent Management

Alignment with Shareholders: The Greens took control after acquiring a fifth of the voting stock, driven by a belief that they could run the business more effectively. Above all, they are shareholders first. Their salaries are modest, significantly lower than those of the previous management six years ago. Crucially, their only variable compensation is directly linked to the share price, unlike most listed companies where incentives are often tied to financial metrics that can be manipulated.

Track Record and Experience: As directors in their early 30s, their professional experience is naturally limited by time. However, they have been immersed in media business and entrepreneurship from a young age, making them exceptionally well-connected. In the five years since taking charge, they have led multiple acquisitions and transformed the company from loss-making to profitable, despite the challenging digital media landscape of the past few years.

Operational Excellence: This is a common weakness among media companies. Creative talent in marketing and advertising often lacks strong business management skills, which can lead to poor execution and shareholder losses. While it is difficult to assess fully from the outside, Oli and Theo have emphasised the careful integration of acquisitions and the development of a tech-enabled business capable of managing increasing complexity. Such clarity in communication is often lacking in the sector.

Corporate Governance: This is one area where Brave Bison falls short, and Wonder Stocks has raised it with the company. The main concern is that Oli Green serves as both chairman and director, whereas best practice usually separates these roles. However, two key factors help offset this. First, Oli and Theo’s 20% ownership stake aligns their interests with shareholders. Second, the company’s restrained executive pay structure suggests conflicts of interest are being avoided. Additionally, Brave Bison has two strong non-executive directors with relevant expertise. Crucially, the Greens have assured Wonder Stocks that they plan to appoint a non-executive chairman and expand the board with additional independent directors, focusing on securing high-calibre appointments rather than placeholders who join boards purely for fees.

Capital Allocation: Many digital marketing businesses are not managed with value creation in mind. This presents significant opportunities for Brave Bison’s leadership to acquire companies burdened by excessive costs or structured more as “lifestyle businesses” (see Appendix II). Once integrated, these businesses can be streamlined, eliminating inefficiencies and refocusing on shareholder returns. Over the past five years, Brave Bison has completed six acquisitions and unsuccessfully pursued one transformational merger (see Appendix III). So far, these acquisitions appear well-judged and accretive to shareholder value, judging by the progression of revenue, profitability, and balance sheet strength.

Honesty and Transparency: Brave Bison excels in this area. Its accounts are clear and easy to understand, while its presentations provide a balanced view of both challenges and opportunities. Follow-up presentations maintain a consistent message, allowing investors to track progress against stated goals. Crucially, the board has shown a tendency to under-promise and overdeliver, reinforcing confidence in its execution (for additional comments, see Appendix IV).

It’s never possible to be certain that a management team has the “it factor”, but Brave Bison exhibits many of the right qualities. In the short term, its share price performance will likely be influenced by positive earnings surprises - common for a business that tends to under-promise - and an upward re-rating. Over the longer term, returns will depend on growth and management’s ability to execute, with industry tailwinds and plentiful acquisition targets tilting the odds in its favour.

Financials

With a relatively short history - much of which was spent fixing the problems of the pre-Green era - there are limited conclusions to be drawn about Brave Bison’s long-term trajectory. However, several key observations stand out:

Since the Greens took over, Brave Bison has transitioned from a loss-making business with revenue of less than £4m to generating nearly £4m in net income on revenue of £20.8m (see Appendix V for details).

Operating as a publicly listed company costs approximately £400k per year. This figure remains stable as a company grows, meaning that at current earnings, PLC costs account for around 10% of profits and 2% of revenue. As revenue grows, this proportion naturally declines, leading to improved operating margins.

Accounting rules can distort a company’s true underlying earnings. Brave Bison’s acquisitions provide a key example; in one case, it acquired a customer relationship that is now its largest client. Accounting standards require that the amount paid above asset value be recorded as “Customer Relationships” on the balance sheet (Note 13, 2023 accounts) and amortised annually as a non-cash expense. However, since the acquisition, Brave Bison has expanded services to this client, generating greater revenue and profit. While the customer relationship has increased in value, accounting rules force Brave Bison to report an annual, non-cash cost - an expense that is best ignored when assessing true profitability.

Brave Bison is arguably still subscale. Businesses of this type typically achieve operating margins of around 30%, while Brave Bison has guided that 25% is a more realistic target. Both figures are well above current levels, but given the management team’s track record of under-promising, a 25% margin should be viewed as highly achievable.

How Much Can Shareholders Make?

Value

Brave Bison isn’t just a digital advertising agency - it’s more like a platform run by two entrepreneurs to create value for shareholders. As of now, it has about £6 million in cash and makes around £4 million in operating profit each year. Thanks to tax losses from before the Green era, it pays less tax right now, but it’s wise to expect normal taxes to kick in later.

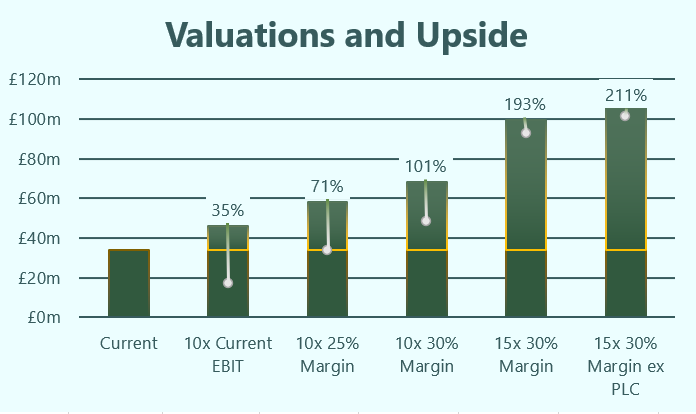

Public market valuations don’t align with private markets, where similar companies often trade at much higher multiples. Comparing Brave Bison to other publicly listed businesses isn’t very useful, as many of them seem undervalued compared to historical norms. In a more typical market, a company like Brave Bison would likely be valued at an EV/EBIT multiple (see the link for details on EV/EBIT) of 10x to 15x.

If Brave Bison boosts its operating margins to 25%, as management predicts, its EBIT (earnings before interest and taxes) could hit £5.2 million. If margins climb to 30%, a common industry standard, EBIT could reach £6.2 million. Plus, if the company were bought out, the acquirer could cut public company costs (around £400k annually), boosting profitability further. Depending on the margin scenario, an acquirer might value Brave Bison’s EBIT between £4.4 million and £6.6 million.

The chart below illustrates this earnings bridge, showing how these factors could lift profitability.

This points to significant growth potential from its February 2025 valuation. Even if profits stay at 2023 levels, a return to normal market multiples could mean a 35% increase in value. But if margins improve and the company trades at a higher multiple, returns could range from 100% to 200%.

Growth

Brave Bison works in a growing industry, though it’s one that goes through ups and downs. Recent years have been tough, but the company should still grow naturally. On top of that, buying or merging with other businesses should boost growth even more. These moves let Brave Bison cut costs, streamline operations, and sell services to more clients. The Greens, who run the company, have already proven they’re good at spotting and pulling off deals that add value.

They tried to merge with Mission Group, a struggling company with big revenue but weak profits. Mission Group had signs of a “lifestyle business” - fancy offices but thin margins. If the deal had worked, the Greens could have saved a lot of money and made both companies’ shareholders better off. Sadly, Mission Group sold its best piece since then, so a future deal seems unlikely. Still, that attempt shows Brave Bison’s potential to get much bigger.

Instead of seeing it as a fixed business, think of Brave Bison as a launchpad for creating big shareholder value through smart deals and expansion. It’s hard to predict exactly what Oli and Theo will achieve, but a solid long-term plan could multiply the company’s worth over time. Right now, Brave Bison is valued at about £35 million. It’s easy to imagine it hitting £1 billion one day - and, whilst some of that will doubtless occur with issued equity, it will make shareholders a lot of money along the way.

Brave Bison is Very Compelling

Investments are often classified as either “value” or “growth,” but Brave Bison embodies both. It is undeniably cheap, particularly given the strong growth achieved during the Green era and the broader expansion of its industry. More importantly, the business is led by two highly astute, well-connected, and properly aligned directors. While patience will be required to realise the full potential of this investment, Wonder Stocks expects that patience to be richly rewarded.

Would you bet on two young entrepreneurs to outsmart the market?

Appendix

Appendix I: Brave Bison Adjustments to Profitability

The chart below provides a breakdown of Brave Bison’s adjustments to profitability, reflecting the impact of its turnaround strategy and multiple acquisitions.

• Green bars indicate adjustments that are clearly justified.

• Orange bars represent adjustments that are probably appropriate.

• Red bars highlight items that should not be adjusted.

Impairments and acquired asset amortisation are accounting entries, not economic realities. These are non-cash charges, and in some cases - such as the amortisation related to Brave Bison’s largest client - they may even give the opposite view of the true earnings picture.

The equity-settled charge relates to the assumed cost of fulfilling the company’s long-term incentive plan (LTIP), which only vests if the share price exceeds 3p. Wonder Stocks’ analysis already assumes full vesting of these incentives, incorporating them into calculations via a diluted share count. Including the LTIP charge in profitability calculations would therefore result in double counting.

Acquisition costs are deal-specific. As a serial acquirer, Brave Bison incurs these, but each is a one-off. If the company were to stop acquiring businesses, these costs would disappear while the existing business continues to operate profitably.

Restructuring costs should be evaluated carefully. While one-off restructuring charges are generally non-recurring, Brave Bison’s acquisition-led strategy means some level of restructuring will always occur as it integrates new businesses and removes inefficiencies. However, a significant and unknowable portion of these costs relates directly to acquisitions rather than the underlying business.

Depreciation is a standard expense and should always be included in costs. However, it’s worth noting that Brave Bison operates with a very asset-light business model.

Appendix II: Lifestyle Businesses

Many marketing firms operate as lifestyle businesses, benefiting owner-directors over shareholders. A lifestyle business prioritises steady income and personal freedom over aggressive scaling, often resulting in lower reinvestment, slower growth, and misaligned incentives for external shareholders. While excellent for founders seeking financial independence, these businesses can be poor investments if they lack reinvestment, innovation, or shareholder alignment.

Appendix III: History of Acquisitions

Greenlight Digital: Acquired in 2021, Greenlight Digital is a digital marketing agency specialising in search engine optimisation and e-commerce solutions. This acquisition bolstered Brave Bison's performance marketing services, enabling the company to offer a more comprehensive suite of digital solutions to its clients.

Greenlight Commerce: Acquired alongside Greenlight Digital in 2021, Greenlight Commerce specialises in e-commerce platform development. This acquisition complemented Brave Bison's existing services, providing clients with robust e-commerce solutions.

Best Response Media: Also acquired in 2021, Best Response Media is an e-commerce agency focused on Magento platform solutions. This addition strengthened Brave Bison's e-commerce capabilities, allowing the company to deliver enhanced online retail experiences for its clients.

Southpaw: Acquired in 2022, Southpaw is a creative agency known for its work in brand strategy and content creation. This acquisition expanded Brave Bison's creative services, enabling the company to offer end-to-end marketing solutions from strategy to execution.

Social Chain: Acquired in early 2023, Social Chain is a social media advertising agency co-founded by entrepreneur Steven Bartlett. This acquisition enhanced Brave Bison's capabilities in social media marketing and broadened its client base to include prominent brands such as TikTok and Amazon Prime Video.

Engage Digital Partners: In December 2024, Brave Bison announced the acquisition of Engage Digital Partners, a sports marketing agency.

In addition to these acquisitions, Brave Bison attempted a merger with The Mission Group in mid-2024. The rationale behind this move was to create a more substantial entity capable of competing more effectively in the digital marketing and advertising industry. Brave Bison raised its all-share offer for The Mission Group from £27m to £32.3m - a 55% premium. The Mission Group appears to operate more like a lifestyle business, with high costs and generously compensated directors. Brave Bison believed it could make the business more efficient to the benefit of shareholders. However, The Mission Group's board unanimously rejected both proposals, describing them as "opportunistic" and asserting that they undervalued the company's prospects. Following these rejections and a lack of constructive engagement, Brave Bison decided to abandon its takeover efforts in June 2024.

Appendix IV: Governance and Related-Party Transactions

One potential governance concern with Brave Bison is the Greens’ continued involvement with Tangent Marketing Services and The Printed Group. While full disclosures are available in Note 27 of the Brave Bison accounts, a key summary is that the company actually benefits financially from these relationships rather than the other way around.

The majority of these transactions consist of Brave Bison billing Tangent and The Printed Group for shared central expenses, such as office space. In 2023, Brave Bison received £330k from these entities while incurring £67k in charges, resulting in a net gain of £263k. All expenses are independently reviewed, ensuring transparency and mitigating conflicts.

Oli and Theo Green have also made it clear that their reputation is their priority. Owning 100% of Tangent and 20% of Brave Bison, they argue it’s illogical to jeopardise credibility for small sums.

Appendix V: Notes on Financials

The income statement lists Revenue and Gross Profit, with the difference being Cost of Sales. However, it's more insightful to view Gross Profit as Brave Bison’s true revenue.

The reason? Media buying services. Brave Bison acts as an intermediary for media buying, handling client spending without charging a direct fee. This artificially inflates Revenue and Cost of Sales, without generating profit. This means a significant portion of reported revenue isn’t actually profit-generating - it’s just an accounting technicality.

For example, in 2023, Brave Bison reported:

• Revenue: £35.7m

• Cost of Sales: £14.8m

• Gross Profit: £20.9m

That £14.8m in Cost of Sales was purely a pass-through amount. Because of this, Wonder Stocks focuses on Gross Profit as the company’s true revenue figure, ignoring the inflated Revenue line.

Disclaimer:

The author of this Wonder Stocks piece is Jamie Ward. As at time of writing, he owns shares in Brave Bison. Unless stated otherwise, all sources of information come from Brave Bison Report and Accounts, Brave Bison presentations, meetings with Brave Bison and Wonder Stocks’ analysis.

Nice article! I’m subscribing! Please do the same! Fascinating times in the financial markets

How is the chairman also being a director a problem? Is the chairman of any UK company not literally a director by law?

Also, share count has more than doubled since 2020. Are you sure we’re not just looking at two brothers using shareholder’s capital to build an empire? I know profitability has massively improved in that time, but not sure how much of this was a result of the acquisitions versus just improvement at the core business? Have they overpaid for prior acquisitions?

Also, can we really trust those acquisition and restructuring costs aren’t more underlying than they suggest?

Sorry for question spam - thanks for answering! Very interesting company.