Imagine a business quietly stitching together a patchwork of smaller players in a fragmented industry, turning modest operations into a powerhouse of scale and efficiency. It’s not a difficult thing to imagine because many have done it successfully before. It’s not a flashy tech unicorn or a household name, but a disciplined operator with a knack for spotting undervalued gems, snapping them up, and weaving them into a cohesive, profit-churning machine. The beauty lies in its simplicity: a proven playbook, a vast playing field of opportunities, and a team that knows how to execute. This isn’t a speculative bet on a distant future – it’s a compounding story unfolding right now, with a valuation that seems to have missed the memo on its potential.

What makes this tantalising is the runway ahead. The sector it operates in is ripe for consolidation, with scores of small, family-run businesses waiting for the right suitor. The management isn’t just dreaming big – they’ve already delivered, time and again, with a process so robust it feels like a conveyor belt of value creation. A stock that could deliver well over 600% in shareholder returns on an initial investment over the next decade and if things go really well, it could be a 10 bagger.

Note: Wonder Stocks seeks to provide a narrative argument for its investment case. Nevertheless, supporting figures and charts can be found in the Appendix and section How Much Can Shareholders Make.

Discover more wonderful investment ideas here.

Wholesale Success

That business is Kitwave, a UK-based wholesaler that’s mastering the art of buy-and-build. Based in North Shields, this isn’t a newcomer – it’s a proven player that has delivered real value, yet still trades at a fraction of what its trajectory suggests. The opportunity is clear: Kitwave has a formula that works, a sector with endless targets, and a leadership team that’s young, seasoned, and relentlessly focused. Like Brad Jacobs – the serial dealmaker behind logistics giants XPO, GXO, and now QXO – Kitwave’s story is about turning fragmented markets into streamlined profit engines. The difference? Kitwave is earlier in its journey, with a valuation that leaves room for outsized returns.

The numbers whisper potential. With a market cap still modest relative to its ambitions, Kitwave could follow a Jacobs-esque path where disciplined acquisitions and operational excellence drive multiples of growth. Recent results show revenue climbing and a pipeline of deals already boosting earnings, yet the stock lingers at a price that feels like a gift for those paying attention. This is a chance to back a management team that’s not just talking about consolidation – they’re doing it, with a track record that rivals the early days of Jacobs’ empire-building. Details of Jacob’s successes as well as other UK buy-and-builders can be found in the Appendix.

From Cash-and-Carry to Consolidation King

Kitwave started as a humble cash-and-carry operation on Tyneside, serving corner shops and small retailers with everyday essential; snacks, drinks, and frozen goods. It’s not glamorous, but it’s the backbone of the UK’s independent retail ecosystem, a £13.3 billion market for impulse items alone. Over the years, it’s morphed from a single depot into a network of nearly 40, employing over 2,000 people. The secret? A relentless focus on buying up regional wholesalers – names like Wilds of Oldham, Total Foodservice, and Creed Catering Supplies – and integrating them into a lean, efficient whole.

This isn’t haphazard growth. Kitwave’s process is methodical: scout targets with strong local roots, assess their fit, pay the right price, and then streamline operations to unlock synergies. Kitwave’s scale is still small, but its discipline is similar to some of the very best to have done it before.

From Foundations to Consolidator

The history of the company can be split into three:

1. Excellent Underpinnings – 1987 to 2011

Kitwave was launched in 1987 when Paul Young established the business in North Shields, Tyne and Wear, as a modest confectionery wholesaler. It carved out a solid niche, rooted in the cash-and-carry model where customers visited the depot to stock up. The early years demanded grit and groundwork – a slow burn, with Young guiding a steady course. By the early 2000s, Kitwave had solidified its status as a regional stalwart, though it remained a relatively small operation. It was a well-run but modest business compared to its scale today. By the late 2000s, it was generating around £100 million annually in revenue and around £1.7 million a year in pre-tax profits.

2. New Equity – 2011 to 2021

It’s unclear how the connection came about, but in 2011, NVM Private Equity acquired a stake in Kitwave and injected substantial capital backing Paul Young. This enabled him to acquire smaller competitors and instil his signature operational excellence. Supporting him was David Brind, the current CFO, who joined the business from NVM providing him with financial expertise. The first acquisition was Automatic Retailing in September, and along with it the finance director, Ben Maxted. Over the next decade, Kitwave completed ten acquisitions. The revenue and operating profits through this period expanded more than five-fold from a mixture of organic and acquired growth. As is common with private equity, the NVM investment had a fixed term. In this case, it was ten years, which allowed NVM to exit its stake in the expanded group when Kitwave listed on the AIM market in May 2021.

3. A Public Company – 2021 to Present

When Kitwave listed, it secured a valuation of just over £100 million. By then, Paul Young, in his mid-60s, seized the moment to step back from the business. He and his family retain an approximate 10% stake, signalling confidence in the current leadership. Indeed, David Brind, who served as Young’s CFO for several years, remains in the role. Ben Maxted, who had been with the company 14 years by this time, was elevated to CEO in 2024. The buy-and-build strategy that defined its private equity-backed decade persists, with five additional acquisitions completed since the initial public offering (IPO). In late 2024, it made its largest acquisition yet – Creed Catering Supplies – partly funded through an equity issuance that raised £31.5 million and increased the share count by 14%. Since listing nearly four years ago, Kitwave has grown by roughly 80%.

A Fragmented Feast

The wholesale sector Kitwave operates in has a great deal of opportunities. Unlike consolidated industries dominated by a few giants, this is a landscape of small, family-owned players lacking the scale or capital to compete with larger networks. Kitwave steps in as the consolidator, offering cash to owners ready to retire or scale to those needing a partner. Competitors such as Booker (owned by Tesco) and Bestway target larger customers who order in lorry-loads, leaving Kitwave to dominate a niche of smaller businesses with its van-based, small-quantity deliveries. The foodservice division, boosted by deals like Creed, taps into a growing demand from cafés, pubs, and caterers.

As with many buy-and-build opportunities, success hinges on several key factors. The market must be highly fragmented, offering ample room for expansion. Valuations must be approached with strict discipline to avoid overpaying. Most crucially, management must have a proven integration strategy to ensure that acquisitions form a cohesive, efficient business rather than a patchwork of smaller entities.

Kitwave meets all these criteria, creating the perfect conditions to continue its acquisition spree with each deal a step toward greater scale and profitability. More importantly, this strategy serves as a powerful engine for value creation and shareholder returns.

The Road Ahead

Kitwave’s future relies on maintaining its proven formula: smart acquisitions, operational efficiency, and steady organic growth. The company’s success will depend on its ability to effectively execute the four core capital allocation priorities outlined by management in the order presented below:

1. Value-accretive acquisitions – acquisitions have been a key driver of Kitwave’s expansion, and management plans to continue pursuing deals that enhance shareholder value.

2. Targeted capital expenditure – Investment in infrastructure, such as the recently opened Southwest delivery hub, is aimed at strengthening distribution capabilities in terms of both scale and efficiency.

3. Progressive dividend policy – Kitwave is committed to steadily increasing shareholder returns through a sustainable and growing dividend.

4. Conservative balance sheet management – The company aims to keep net debt-to-EBITDA below 2.5x, ensuring financial stability and flexibility.

It’s unclear whether Kitwave’s decision to list Value-accretive acquisitions first in its presentations reflects a deliberate prioritisation of its buy-and-build model. Nevertheless, the management talk a lot about having well-defined processes for acquiring and carefully integrating new businesses and so it is clearly important. As such, expanding through well-priced and carefully integrated acquisitions remains a cornerstone of the company’s strategy. Consolidating its sector through disciplined acquisitions is central to driving long-term growth and enhancing shareholder value. By sticking to this disciplined strategy, Kitwave aims to continue delivering consistent growth and value for its shareholders.

Kitwave should be thought of in a similar vein to other consolidators like Bunzl or Diploma: buy cheap, improve, scale big. For those who are interested, Wonder Stocks highly recommends Brad Jacobs’ book, How to make a few Billion Dollars, which details his highly successful strategy for operating a buy-and-build business. Arguably, no one has done it better than Mr Jacobs, and Kitwave is following his playbook.

How Much Can Shareholders Make?

This section presents a bullish outlook for Kitwave. It will be split into analyses of the Value proposition and the Growth proposition. In completing analysis, certain alterations had to be made to the accounts pre-IPO; details of which can be found in the Appendix 1.

The Value Proposition

Following the acquisition of Creed and the resulting share issuance, Kitwave is projected to generate approximately £45 million in operating profits and £27 million in net income this year. The company is expected to achieve organic growth of around 3% per annum. As of April 2025, its enterprise value (EV) stands at £320 million, with a market capitalisation of £205 million. These figures translate to valuation metrics of EV/EBIT at 7x and a price-to-earnings (P/E) ratio of 7.6x – both notably undemanding. However, modest growth prospects and the broader context of a deeply discounted UK small-cap market temper this apparent cheapness. While the low valuation offers a margin of safety, it alone does not distinguish Kitwave as a superior opportunity among many other undervalued small UK companies.

Several factors, however, bolster Kitwave’s appeal. First, the company is highly cash-generative and operates with relatively low capital intensity. This enables management to sustain a robust and growing dividend, currently yielding over 4.5%. Shareholders thus enjoy a solid return even without share price appreciation. Second, Kitwave benefits from a proven, high-quality management team, recognised as shrewd operators both before and after its stock market listing. Third, the company has significant potential to expand through acquisitions of smaller rivals. Many of these targets are founder-led businesses in the sector, often seeking buyers as their owners near retirement. With limited competition for these deals, Kitwave is well-positioned to secure attractive prices. Fourth, many small companies are as cheap as Kitwave, but bigger, similar companies are worth much more. This makes Kitwave look like a bargain.

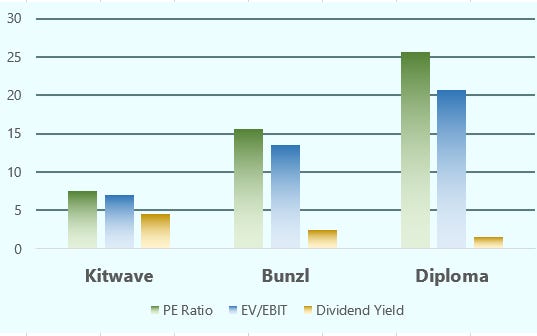

Kitwave’s growth model echoes the trajectories of Bunzl and Diploma, who both evolved from a size comparable to Kitwave’s into FTSE 100 constituents (see Appendix 2 for details). Though operating in different sectors, these companies share similar fundamental strategies. Yet, their valuations far exceed Kitwave’s. Bunzl is a dependable but unexciting business, trading at double Kitwave’s valuation with half the dividend yield. Diploma is past its peak growth years, less disciplined in recent acquisition pricing and commands triple the valuation with a negligible yield. Kitwave, by contrast, arguably has a longer runway to consolidate its market, enhancing its growth potential.

This section, including that written on Bunzl was written prior to the April 16th profits warning.

Taken together, Kitwave appears anomalously undervalued. Its small size means the dividend yield is the most reliable short-term return for investors, but its true value lies in its capacity for long-term growth through strategic expansion.

Growth Projections

As with all buy-and-build strategies, there are significant unknowns. The most successful operators are both opportunistic and disciplined. In his book, Brad Jacobs recounts that in the first four years of XPO’s existence, he and his team conducted due diligence on approximately 2,000 companies but acquired only 17. This rigorous process allowed them to build a comprehensive understanding of XPO’s market, enabling informed decisions on which businesses to buy and at what price when opportunities arose.

Kitwave’s opportunity set is less vast than that of XPO or QXO, but its management team employs a similar approach. They have identified businesses likely to become available in the future, completed due diligence, and determined fair acquisition prices in advance. This preparation suggests that Kitwave’s management possesses the expertise and foresight to drive acquisitive growth, securing targets at attractive valuations and integrating them effectively.

Despite the difficulty in projecting growth, Wonder Stocks offers a credible projection of Kitwave’s future trajectory, based on its historical performance and financial outlook:

• Kitwave has completed over a dozen acquisitions since adopting its current strategy, paying an average multiple of 5.1x EBITDA – approximately 6.5x EBIT.

• Based on 2025 projected earnings, the group is expected to generate £32 million in free cash flow to the firm (excluding debt interest payments but after maintenance capital expenditure).

• After covering the dividend and debt interest, the company should retain around £16 million annually.

• Kitwave targets a debt level of no more than 2.5x EBITDA; it currently stands at approximately 2.0x.

• At present, the company can allocate up to £16 million per year to acquisitions from internally generated cash flow, with an additional £20 million in unused resources available for a larger deal.

• Assuming Kitwave relies solely on internal cash (without additional debt financing) and maintains its historical acquisition multiple, it could add approximately £3.1 million in EBITDA and £2.5 million in EBIT annually.

• This translates to an acquisitive growth rate of 5.5%.

Conclusion

The following outlines a bullish yet realistic ten-year outlook for Kitwave:

• It achieves 3% per annum organic growth. Historically, Kitwave has recorded 6.7% organic growth, partly driven by sales synergies from larger acquisitions. While actual growth could exceed 3%, it’s unlikely to reach 6.7% again. A prudent assumption of 3% is adopted here.

• Acquisition growth averages 5.5% per annum, as the company allocates all resources to acquisitions without exceeding this limit. This is excluding interest and dividend payments.

• The dividend increases in line with earnings growth, maintaining a yield of 4.6% at the current valuation.

• As Kitwave grows, it attracts greater institutional ownership, mirroring the paths of Bunzl and Diploma. This drives its valuation to align with Bunzl’s over time.

If these assumptions hold, net debt would remain stable at £91 million. With earnings rising, debt ratios would decline to a net debt to EBITDA of <1x. By year ten, projections include: EBIT of £76 million, net debt of £91 million, and an EV/EBIT multiple of 13.5x. This implies an enterprise value of £1,020 million and a market capitalisation of £930 million. Compared to the current market capitalisation of £205 million, this delivers a capital return of 350%, or a compound annual growth rate (CAGR) of 16%. Factoring in the 4.6% dividend yield, the total CAGR rises to 21.7%, yielding a total return of 610%.

Several factors could alter this outlook. A valuation closer to Diploma’s could boost the total return by an additional 50%, pushing the return to 10x. Organic growth, likely to exceed 3% modestly, would increase year-ten earnings, though not dramatically. Similarly, greater use of debt could enhance returns. This scenario assumes fixed debt at current levels, but maintaining a 2.0x net debt/EBITDA ratio would unlock an extra £100 million for acquisitions, potentially lifting year-ten earnings by 20% and the total return to around 750%.

Ultimately, this projection is bullish in assuming management sustains its historical skill without setbacks. Yet, it remains realistic – and arguments suggest Kitwave could outperform these estimates. If so, the company could multiply investors’ capital by more than tenfold over the next decade.

Would you bet on a tried and tested strategy to make big returns?

Final Point

The author of this Wonder Stocks piece is Jamie Ward. As at time of publishing, he does not own any shares in KItwave. He is a fundamental analyst by training and presents the fundamental reasoning behind why he believes the shares offer good value. However, his purchases are made with the aid of technical analysis. He believes that the time to buy is very close.

Appendix

Appendix 1

To provide a comprehensive analysis of Kitwave, Wonder Stocks evaluated its financial performance during its periods as both a private and public company. This process presented certain challenges and necessitated specific assumptions:

• In 2020, Kitwave shifted its financial year-end from 30 April to 31 October, resulting in misaligned reporting periods during the transition. Thus, the figures used in the analysis represent an interpolation of two different accounting periods to provide a consistent picture.

• Private companies are subject to less stringent disclosure requirements than public companies. Notably, many private entities, including Kitwave (when still privately owned), adopt FRS 102 rather than IFRS 16 for lease accounting. Under FRS 102, operating leases are not capitalised, whereas IFRS 16 mandates their inclusion on the balance sheet. Given Kitwave’s significant reliance on operating leases, Wonder Stocks estimated their impact during its private phase to enable consistent comparisons with its public company financials. In other words, the pre-IPO accounts were modified by the author to how they would have looked had the company been listed the entire time.

Appendix 2

Bunzl has a long history as a listed company. It first began to pivot towards buy-and-build in the 1980s but became more focused in the 1990s. Its greatest success came whilst Michael Roney (now chairman of Next) ran the business from 2005 to 2016. It supplies a wide range of everyday essentials – like packaging, cleaning supplies, and safety equipment – to businesses across industries such as retail, healthcare, and food service. It operates in over 30 countries, sourcing products globally and delivering tailored solutions to help companies manage their supply chains efficiently.

This section on Bunzl was written prior to the April 16th profits warning.

Diploma shifted its strategy towards a "buy and build" model in 1996, when Bruce Thompson was appointed chief executive. He led the business for 21 years, delivering an exceptional track record during his tenure. Since his retirement, the company has experienced occasional boardroom turbulence, but the share price has continued to climb. Notably, Thompson’s immediate successor stepped down after just four months, before Jonny Thomson took the reins in 2020.

Today, Diploma supplies specialised technical products and services - including seals, controls, and medical equipment - to industries such as aerospace, automotive, and healthcare. Operating on a global scale, it sources and distributes niche components that help businesses maintain, improve, and optimise their operations

Appendix 3

Brad Jacobs is a renowned American businessman and serial entrepreneur with a 44-year career, creating billions in shareholder value through mergers, acquisitions, and technology-driven innovation. In 1989, he founded United Waste Systems, consolidating small waste collection firms, taking it public in 1992, and selling it in 1997 for £1.4 billion, delivering strong returns. That year, he launched United Rentals, growing it into the world’s largest equipment rental firm through acquisitions and tech optimisation – shareholders saw significant gains.

In 2011, Jacobs invested £120 million in Express-1, renaming it XPO Logistics, and via over 500 deals built it into a £16 billion-revenue logistics giant by 2021 – its stock rose over 32 times, ranking it among the Fortune 500’s top performers. He spun off GXO Logistics (£5.6 billion valuation) in 2021 and RXO (£4 billion) in 2022, boosting shareholder value further. In 2024, he founded QXO, targeting the £640 billion building products sector, raising £4 billion and acquiring Beacon Roofing for £8.8 billion in 2025, aiming for £800 million in revenue in year one.

Jacobs has led three IPOs, and completed about 500 acquisitions. His firms – United Waste Systems, United Rentals, XPO, GXO, RXO, and QXO – have generated over £44 billion in shareholder value, leveraging fragmented industries, efficient integration, and top talent.

Below is the total return chart of XPO, which he took on in 2011.

Much like Kitwave, none of Bunzl, Diploma or any of Brad Jacobs’s businesses operate in high growth, flashy industries. Rather they execute acquisitions well and work very hard on operational excellence.

Disclaimer:

The author of this Wonder Stocks piece is Jamie Ward. As at time of writing, he does not own shares in Kitwave. Unless stated otherwise, all sources of information come from Kitwave Report and Accounts, Kitwave presentations and Wonder Stocks’ analysis.

Very good read. Capital allocation & a weak balance sheet are my major concerns with KITW. I think finance expenses and dividend payouts impede their acquisition firepower. I.e. they will pay out ~£9.8m in dividends this year & finance expenses are likely to be ~£5m. Compare that to the £16m available for M&A and the balance looks wrong.

Booker is the obvious comparison, they funded all M&A from a net cash position which makes a world of difference.

I think KITW's dividend should be rebased about 75% lower than the current level. If rates fall back to 2-3% that will reduce their finance costs significantly. The end result would be ~£10m PA more to spend on M&A. Compound that over 10 years and I suspect you'd have more chance of achieving a £1b market cap...

My view is the market valuation is telling them this at present, I.e. we don't believe you can execute this strategy as your debt will become detrimental. Time will tell!

Great write-up. I like the way to start with the narrative and add numbers at the end.